T2D3: The Growth Gold-Standard for SaaS Businesses

T2D3 growth model suggests a playbook for SaaS businesses to grow their business by 72x over 5 years

T2D3 is a growth model for Sales-driven SaaS companies articulated by Neeraj Agrawal, General Partner at Battery Ventures. It is essentially a benchmark for SaaS companies to demonstrate sustained success and scalability to investors.

The model cites the examples of Salesforce, ServiceNow, Workday and Zendesk as companies that have grown by T2D3 standards.

Introduction to T2D3

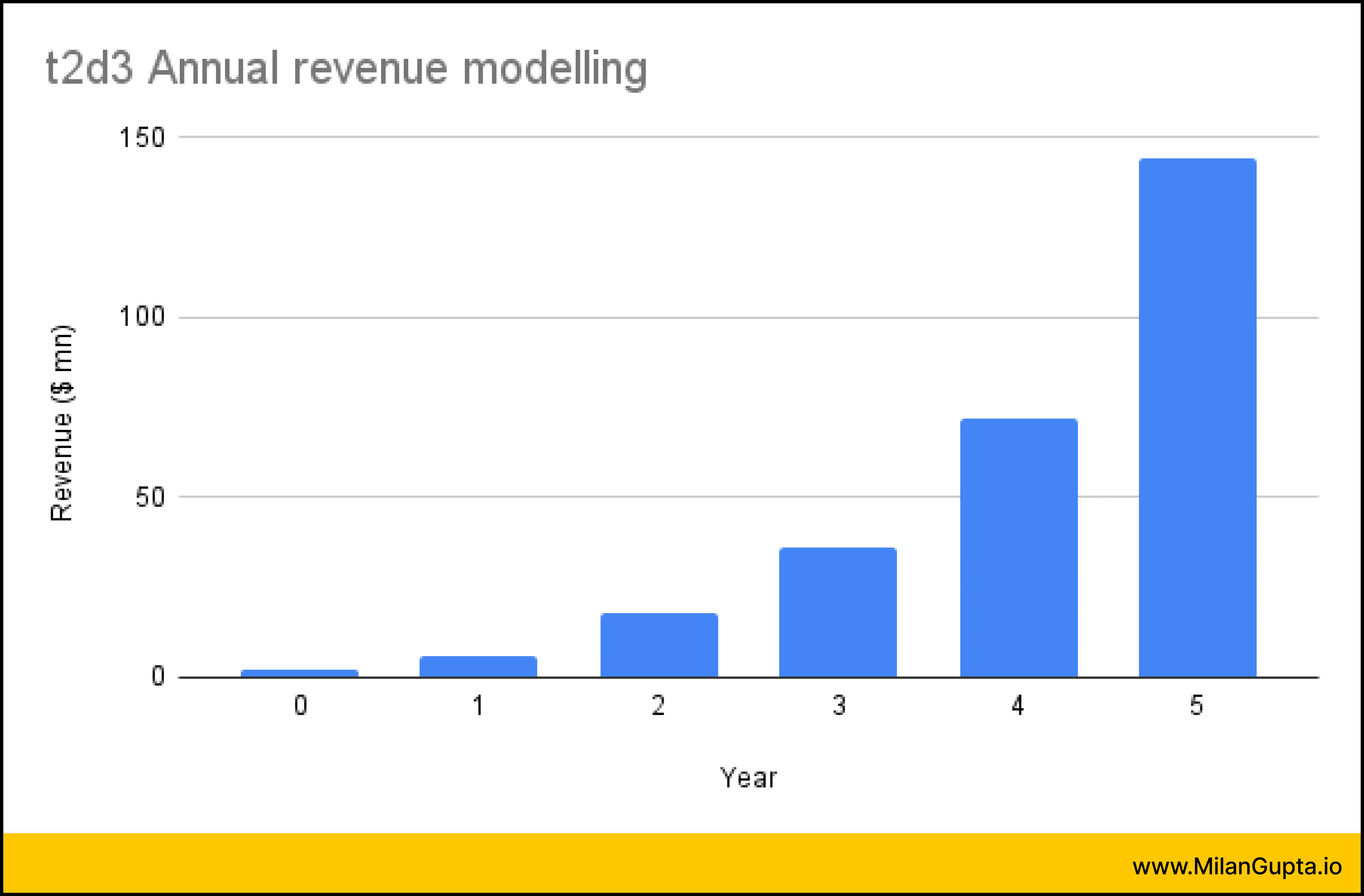

T2D3 is a growth benchmark that stands for Triple, Triple, Double, Double, Double over five years.

Specifically, it aims for a company’s revenue to grow at a compounded rate, tripling its revenue each of the first two years and then doubling it each of the next three years.

Product Marketing Fit & Getting from 0-1

The first step is about finding product-market fit. At this stage, successive customer interviews focused on customer’s pain points and adoption are key. The goal here is to understand the urgency of the customer problem, and how well the shipped product solves for it.

The T2D3 growth model applies after the product-market fit has been established by the company. The model considers $2 million ARR as the starting point at which the company can seek to apply T2D3 framework.

Breaking Down T2D3

Years 1-2 (Triple Each Year): Achieving a 3x revenue growth each year, culminating in a 9x increase after two years. A revenue of $2mn at the start of this period would result in revenue of $18mn at the end of Year 2.

Years 3-5 (Double Each Year): Following up with 2x annual growth, leading to a 72x increase from year 1 to year 6.

This model serves as a structured roadmap, encouraging startups to focus on aggressive yet sustainable growth metrics that are attractive to venture capitalists and other investors.

3 Startups and how they grew

Examining real-world examples of startups that have either achieved or approximated the T2D3 growth trajectory provides valuable insights into the model’s applicability and effectiveness.

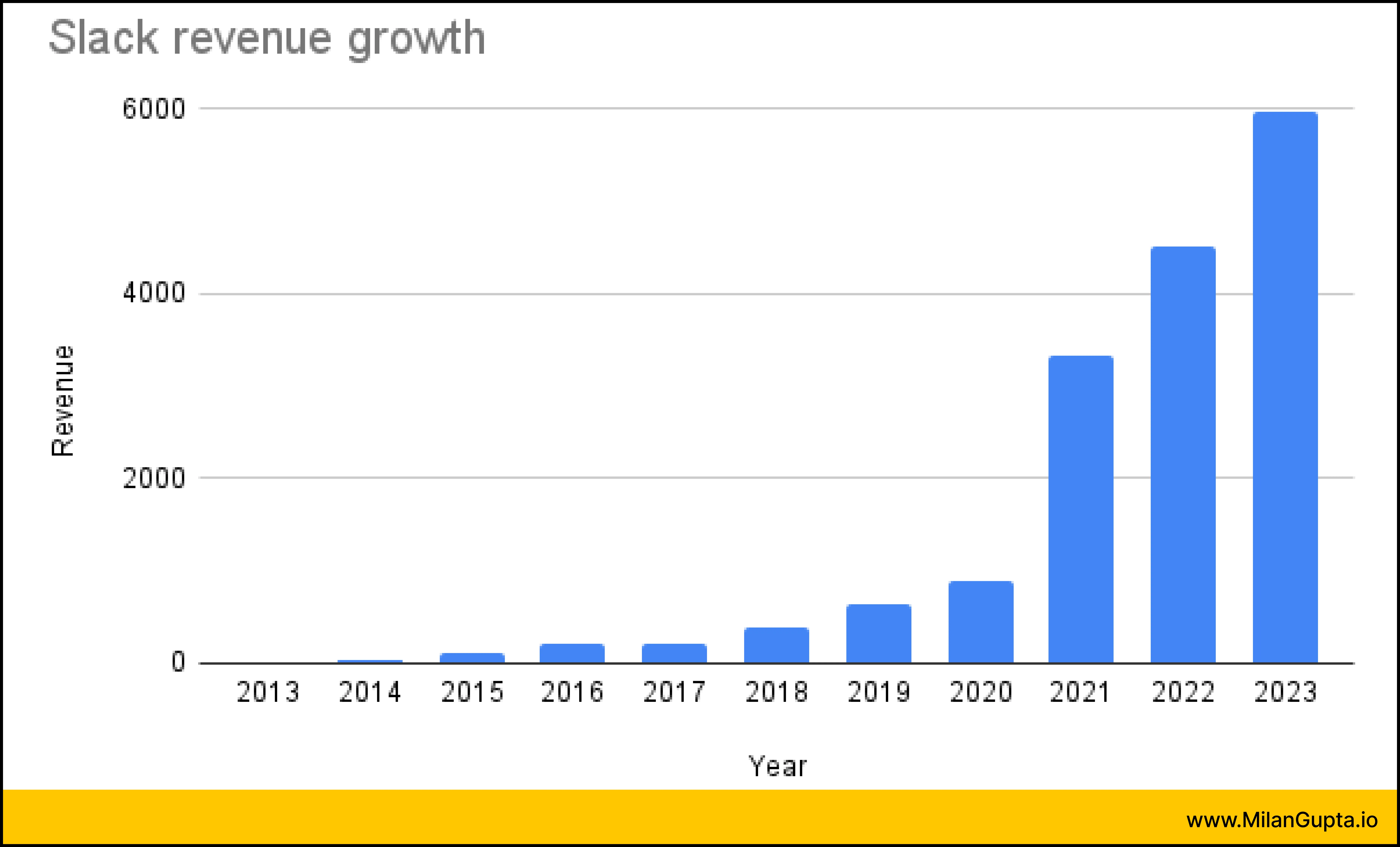

Slack

Slack, founded in 2013, transformed workplace communication by addressing fragmented tools like email and chat apps.

Originally an internal tool for a failed game project, Slack pivoted to solve team collaboration challenges. Its beta launch in August 2013 attracted 8,000 users within 24 hours and 15,000 in two weeks. By February 2014, Slack officially launched, earning $1M in subscriptions within three days.

Slack’s product philosophy was to transform how people work.

Slack’s freemium model and intuitive design fueled viral adoption among small teams and startups. By 2015, it had over 500,000 daily active users and was valued at $1B. Features like channels, integrations with tools like Google Drive and Trello, and a focus on user experience set it apart.

Slack’s unique design choices, integrations and cross-platform accessibility made it amongst the most successful SaaS companies in 2010s.

In 2017, Slack launched Enterprise Grid to target large organizations, securing clients like IBM. Acquired by Salesforce in 2020 for $27.7B, Slack now integrates deeply into enterprise workflows, serving over 344,000 customers globally by 2025.

(data source: Business of Apps )

(data source: Business of Apps )

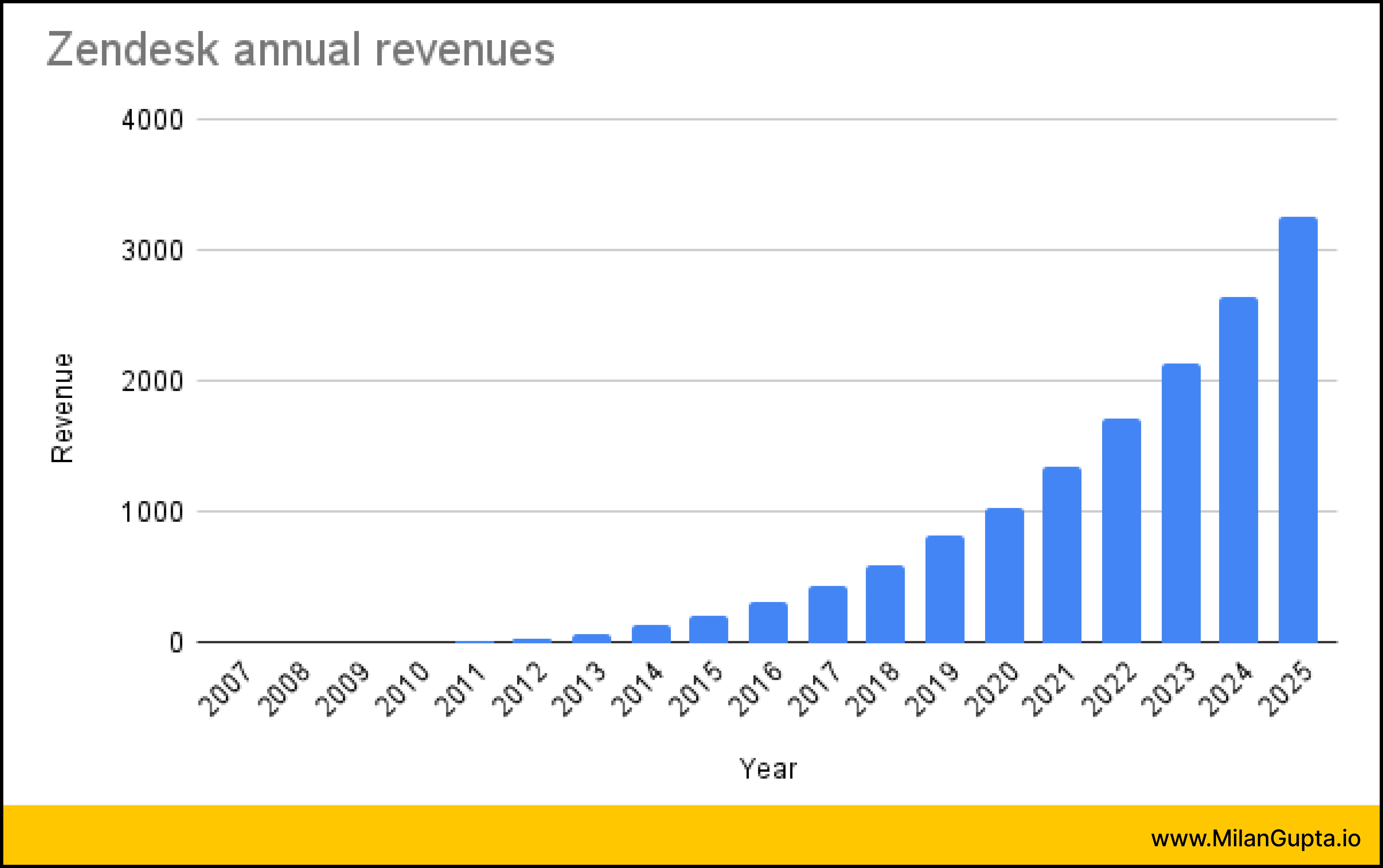

Zendesk

Zendesk was founded in 2007 in Copenhagen to simplify customer support. It addressed the complexity of traditional help desk software by offering a cloud-based, user-friendly solution.

By 2011, Zendesk generated $15.6M in revenue, growing to $38.2M in 2012. Its intuitive design and scalability attracted small and large businesses alike.

The company went public in 2014, reporting $127M in revenue that year. By 2018, it surpassed $598.7M, driven by increasing adoption of omnichannel customer support tools. Zendesk expanded its offerings to include live chat, analytics, and AI-driven automation.

By 2020, annual revenue exceeded $1B as businesses prioritized digital customer engagement during the pandemic. In 2022, Zendesk reached $1.72B in revenue, serving over 100,000 customers globally. Its growth reflects rising demand for seamless customer experiences across industries. Zendesk’s focus on innovation and ease of use continues to drive its adoption among enterprises worldwide.

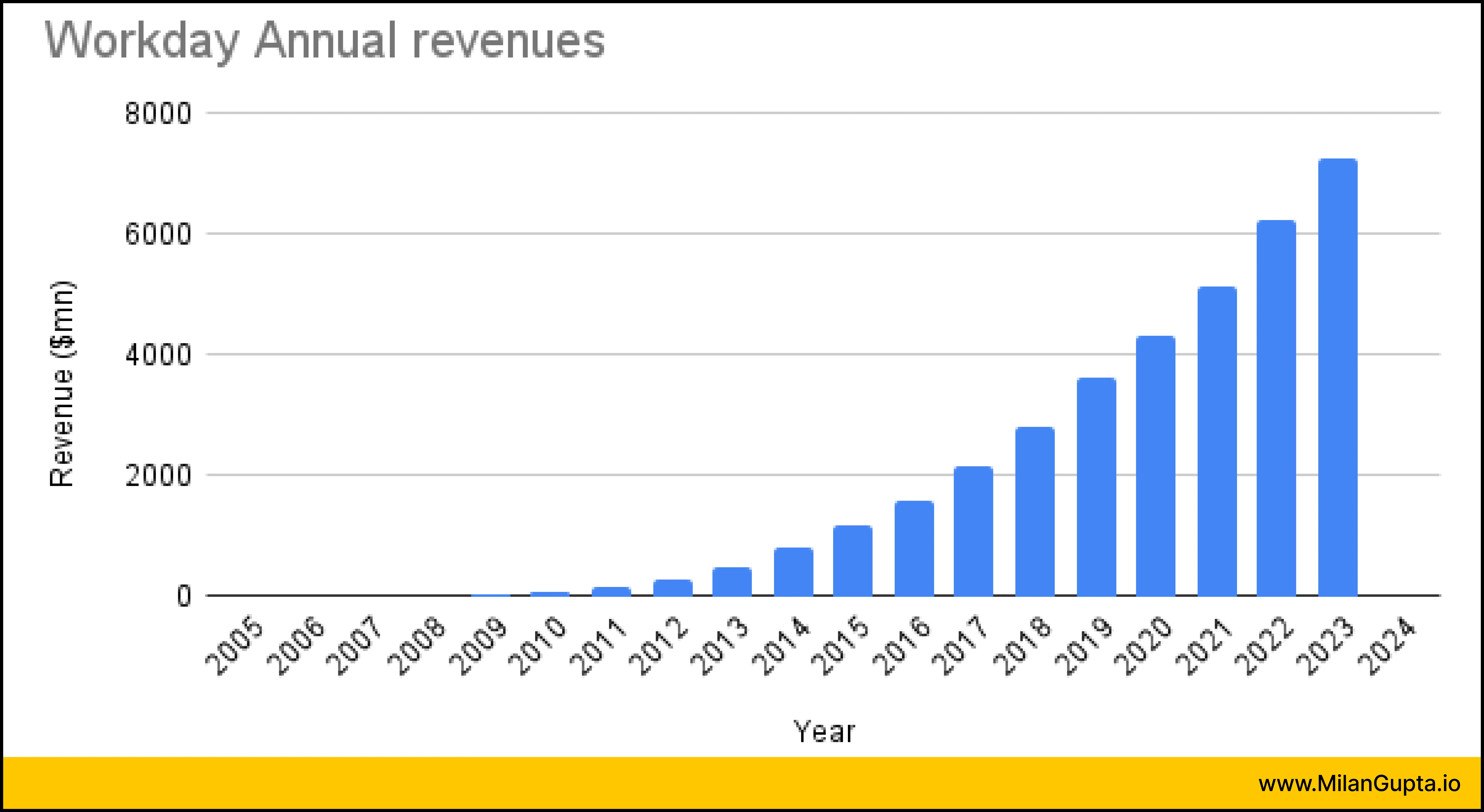

Workday

Workday, founded in 2005, revolutionized enterprise software by offering cloud-based solutions for Human Capital Management (HCM) and Financial Management.

Workday’s focus was on limitations of on-premises ERP systems, providing flexibility, scalability, and real-time insights. By 2009, Workday had over 100 customers and launched its Financial Management product in 2010 to complement its HCM suite.

Adoption grew rapidly due to its user-friendly interface and continuous innovation. In 2018, Workday acquired Adaptive Insights for $1.55 billion, enhancing its planning and analytics capabilities. By 2020, it served over 3,000 customers globally, including 40% of the Fortune 500.

Workday embraced AI in 2024, integrating machine learning into its platform to automate workflows and enhance decision-making. Its annual Workday Rising event showcased innovations like AI-driven analytics and Career Hub for employee development. Today, with over 10,500 customers worldwide, Workday remains a leader in cloud ERP solutions, driving enterprise transformation through innovation.