The Ultimate Guide to B2B SaaS Metrics: Understanding ARR, ACV, and Beyond

A deep dive into the key metrics that drive B2B SaaS valuations, featuring real-world examples from Atlassian, Salesforce, and HubSpot

In the complex world of B2B SaaS, metrics tell the story of a company’s health and potential. Whether you’re a founder seeking funding or an investor evaluating opportunities, understanding these metrics is crucial. Let’s decode the most important ones using real-world examples from industry leaders like Atlassian, Salesforce, and HubSpot.

Valuation: The Metric that captures the business value & potential

Valuation in SaaS isn’t just about current revenue.

It is a reflection of the market opportunity and execution capability.

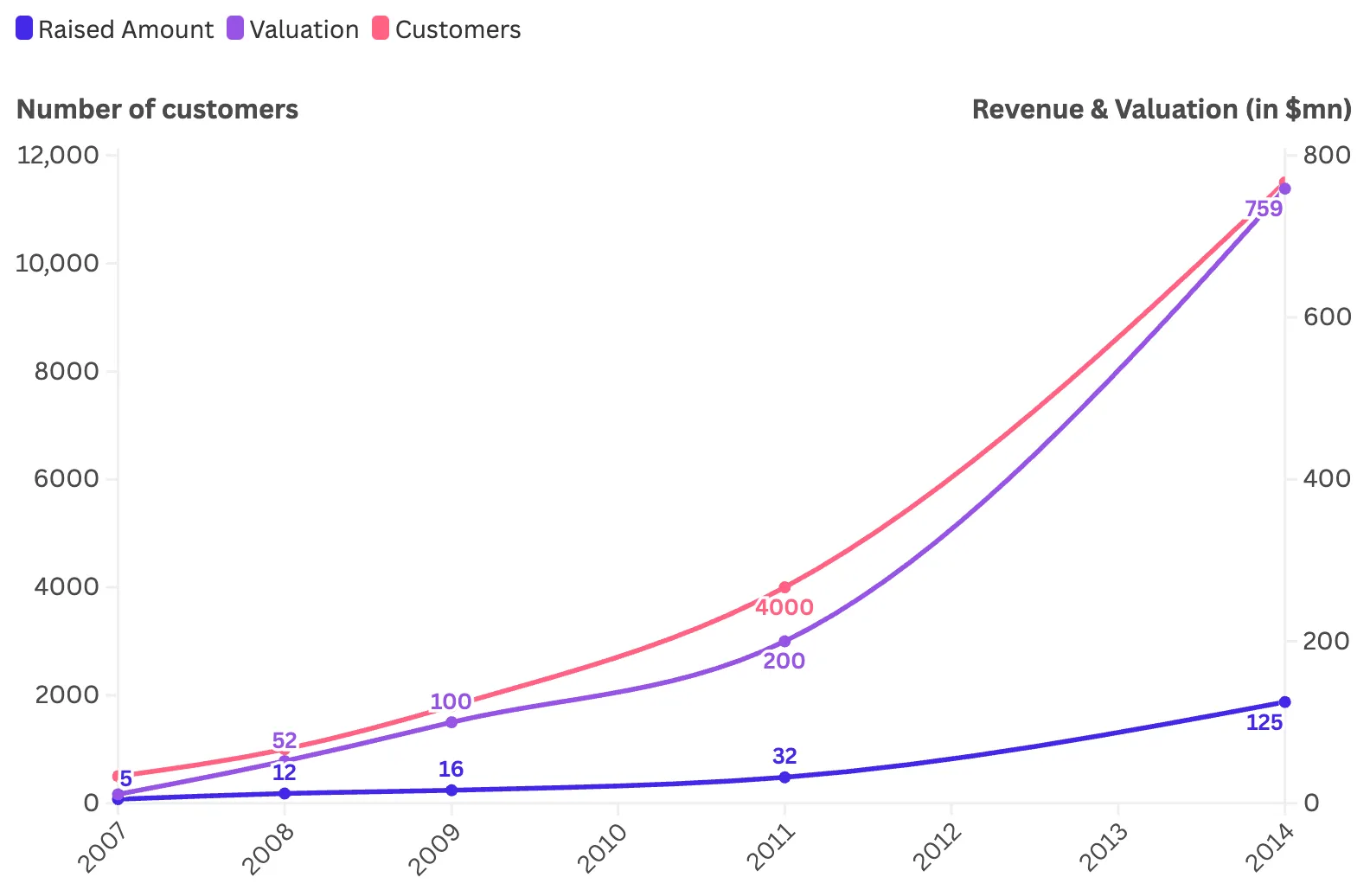

Take HubSpot’s journey. Hubspot started with an $11 million Series A valuation in 2007. Over the next 2 decades, Hubspot’s valuation has jumped to over $25 billion in 2024.

This growth was built upon the tailwinds of Search Engine driven inbound marketing. Hubspot pioneered the idea of inbound - that as marketers, you don’t just have to buy advertising spots or as salespersons you don’t have to just do outbound sales. In the new paradigm that emerged in 2000s, your prospects will find you.

What you have to do is make it easy for them to find you - distribution, and when they do, share a compelling value proposition with them.

Coupled with high-quality GTM & expansion, Hubspot’s valuation reflects the continued strength of their business.

| Year | Round | Amount | Post-Money Valuation | Customers | Key Investors |

|---|---|---|---|---|---|

| 2007 | Series A | $5 million | $11 million | <500 | General Catalyst |

| 2008 | Series B | $12 million | $52 million | 1,000 | Matrix Partners |

| 2009 | Series C | $16 million | $100 million | 1,800 | Scale Venture Partners |

| 2011 | Series D | $32 million | $200 million | 4,000 | Sequoia Capital, Google Ventures, Salesforce.com |

| 2014 | IPO | $125 million | $759 million | 11,500 | Public Market |

Annual Recurring Revenue (ARR): The Growth Engine

ARR is perhaps the most critical metric in SaaS.

ARR places an emphasis on the recurring nature of revenue that has become commonplace in SaaS.

Conceptually, ARR is a leading indicator of the revenue that the business expects to generate in a period of 1 year. It captures all the deal sizes - monthly, quarterly, or annual, and projects the revenue that they will generate in a calendar year.

ARR is impacted by three factors:

- Is the revenue contracted or executed - it is standard for businesses to enter into an agreement on the cost of services and the amount of services needed. For a workplace productivity software service, this may mean number of seats/ licenses given. For a payment gateway, this may mean the total biling & number of transactions facilitated. In essence, Contract revenue is a projection agreed upon by the seller and the buyer. Revenue is executed when the service is actually delivered.

Consider this hypothetical scenario featuring Atlassian. Their contract with Acme Corp is for 50,000 seats to Jira at a rate of $100/ seat. However, owing to internal adoption & average Net promoter scores within the org, actual usage is limited to 10,000 seats.

Enterprise Deal Example:

- Contract: 50,000 seats @ $100/seat

- Contracted ARR: $5 million

- Actually deployed: 10,000 seats

- Execution ARR: $1 million

While contracted ARR looks impressive in press releases, execution ARR is what investors care about. It represents real usage and customer value delivery.

- New customers, churn & upsells - ARR changes because of these 3 reasons.

SaaS businesses are heavily reliant on existing customers. Strategically, Customer Success as opposed to Sales has emerged as the most relevant function. CS owns churn & upsell components of ARR. On the other hand, new customers part of the revenue is owned by Sales teams.

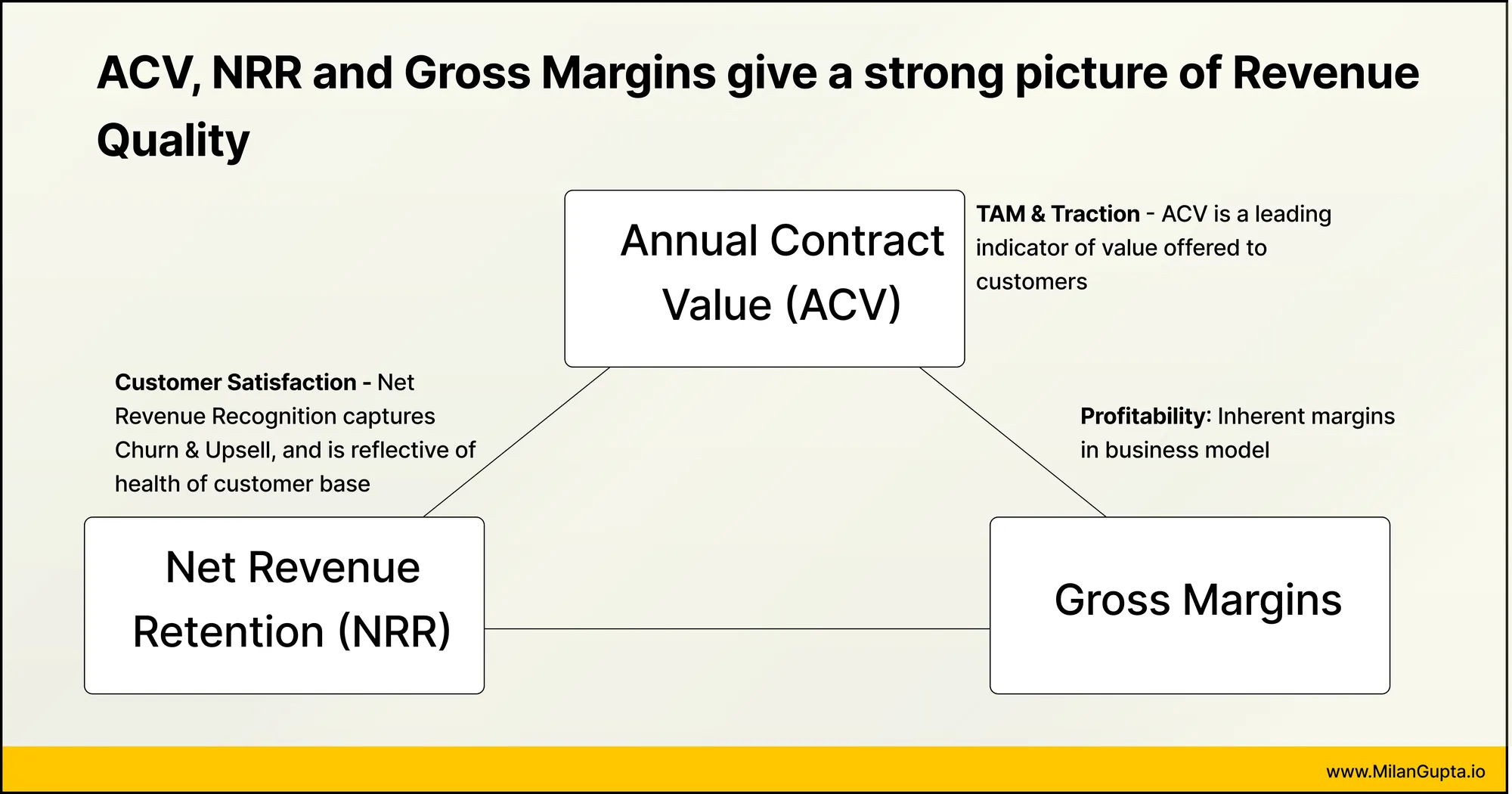

The Revenue Quality Triangle

1. Net Revenue Retention (NRR)

This metric is the holy grail of SaaS health. Best-in-class companies like Snowflake maintain NRR above 160%, meaning existing customers spend 60% more each year. A healthy NRR looks like:

- Enterprise SaaS: >120%

- Mid-market: >110%

- SMB: >100%

2. Annual Contract Value (ACV)

ACV helps understand your customer segmentation and go-to-market efficiency. For instance:

- Salesforce Enterprise: $120,000+ ACV

- HubSpot Professional: $15,000 - 50,000 ACV

- Atlassian Team: $5,000 - 15,000 ACV

3. Gross Margin

Let’s break down a realistic SaaS cost structure using Mailchimp as an example:

Revenue: $1,000 annual contract

Costs:

- Infrastructure (AWS): $60

- Third-party services: $20

- Onboarding support: $30

- Customer success tools: $10

- Technical support: $30

Total costs: $150

Gross margin: 85%

Valuation Multiples: The Market’s Verdict

Modern SaaS companies are valued using two primary metrics:

- ARR Multiple

- High-growth companies (>80% YoY): 20-30x ARR

- Moderate growth (40-80% YoY): 10-20x ARR

- Stable growth (<40% YoY): 5-10x ARR

- Operating Margin Multiple

- More relevant for mature companies

- Industry average: 15-25x operating profit

- Premium players like Salesforce: 30-40x

Operating Costs: The Reality Check

For early-stage SaaS companies, operating costs typically break down as:

- R&D (Product & Engineering): 35-45%

- Sales & Marketing: 40-50%

- G&A: 15-20%

This usually results in negative operating margins for the first few years, with a path to profitability at scale. Successful companies like Zoom and MongoDB have shown that prioritizing growth over early profitability can lead to stronger market positions.

Rule of 40 - the bar for SaaS at Scale

The rule of 40, articulated by Brad Feld in 2015, suggests that for SaaS businesses at scale, the sum of Annual revenue growth (in %), and profit margins (EBITDA, in %), should be 40%

Rule of 40 = ARR Growth (%) + EBITDA (%)

By bringing in Revenue & Profitability in the same equation, the metric captures overall business health.

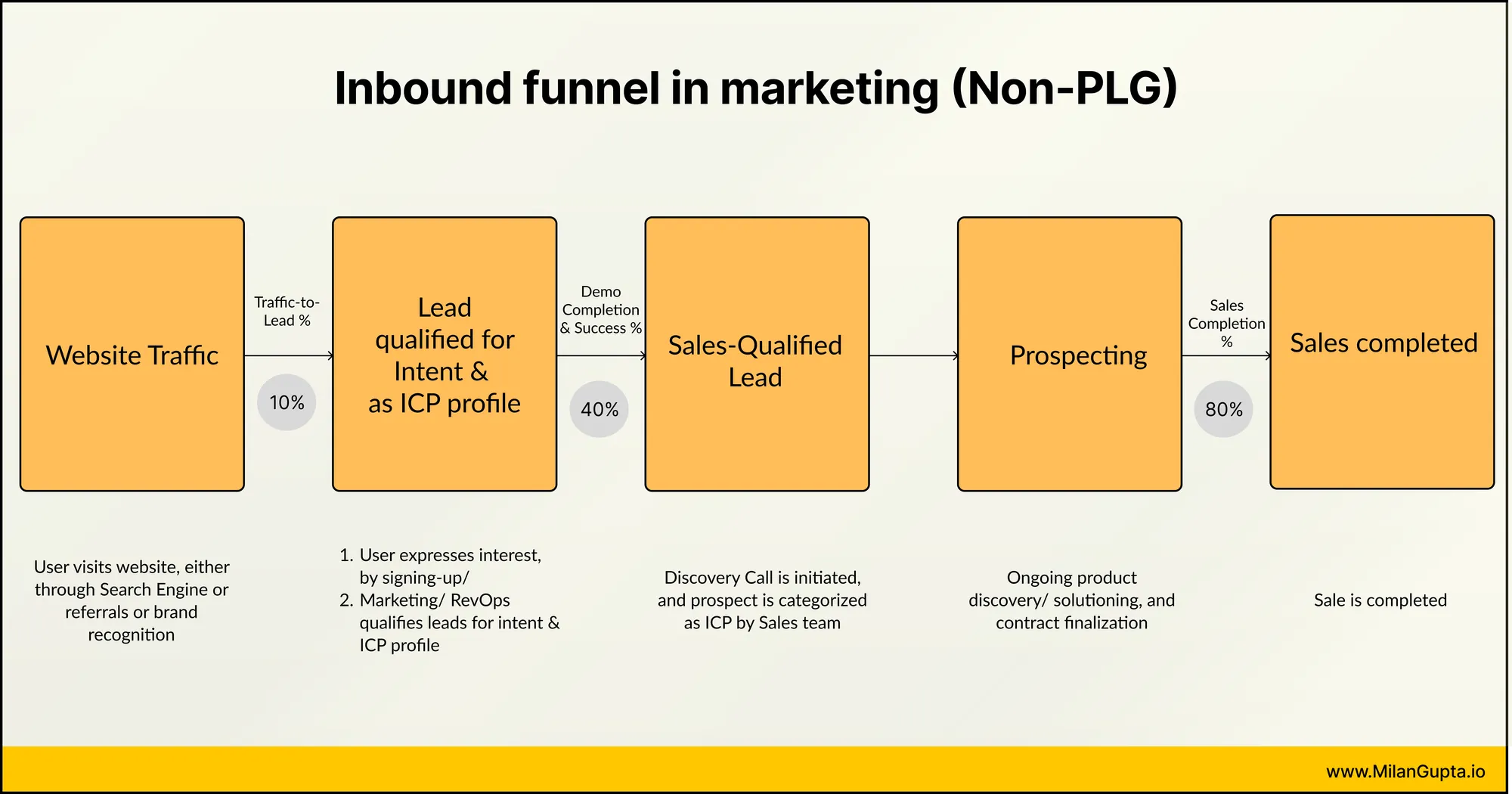

Marketing Metrics & Sales Pipeline for SaaS businesses

Sales Pipeline - Leads, MQLs, SQLs, Customers

The Bottom Line

Understanding these metrics isn’t just about tracking numbers—it’s about building a sustainable SaaS business. The most successful companies maintain a delicate balance between growth and efficiency, using these metrics as their compass rather than their destination.

Remember: While these metrics provide a framework, exceptional companies often break the mold. Slack’s viral growth or Zoom’s efficiency metrics showed that innovation in business models can rewrite the rules of what’s possible in SaaS.